Education

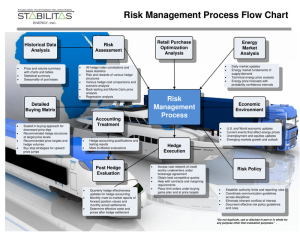

We believe that a successful risk management program begins with gaining a thorough understanding of hedging. This understanding begins with education. The education process serves as the foundation for the program. Solid education yields a strong foundation.

This foundation will serve as the platform from which to communicate and champion internally and externally. It will also serve to educate others and properly manage expectations. Last but not least it will enable you to gain cost stabilization and budget predictability in a cost efficient and prudent manner.

This foundation will serve as the platform from which to communicate and champion internally and externally. It will also serve to educate others and properly manage expectations. Last but not least it will enable you to gain cost stabilization and budget predictability in a cost efficient and prudent manner.

We teach Hedge Schools and host Webinars to help our clients throughout the process. Hedging can be quite complex for companies to navigate both internally and externally. Check out our Agenda for a more detailed description. In these instructional seminars we overlay your business goals and objectives with a thorough understanding of the Energy Markets including the drivers of pricing and macroeconomic theory. We then discuss various methodologies including: futures, forwards, and over-the-counter instruments. We explain basis risk and the various financial hedge instruments that can be utilized while presenting a balanced approach explaining the pros and cons of each structure and indentifying not only the potential rewards but also the risks. We discuss the implications of margining and credit requirements and risk. Having worked with many clients in various industries we are able to share experiences of what has and has not worked. Through this experience, we guide clients as to best practices that are implemented by companies today. We help with the commercial transaction and show you how to transact. But it doesn’t end there. We also help with the back office reporting and interfacing with internal and external auditors as to the implications of various accounting treatments. Lastly, we help you build a solid risk management program with a thorough assessment of the risk and rewards of the program that enable you to guide your organization in gaining stabilization and predictability.

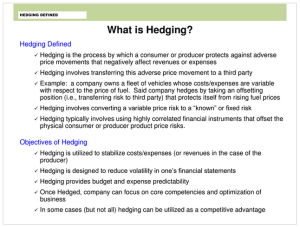

But you may ask “What is Hedging”?

Hedging is the process by which a consumer or producer protects against adverse price movements that negatively affect revenues or expenses. Hedging involves transferring this adverse price movement risk to a third party. Hedging is used to stabilize costs or revenues. Hedging provides budget and expense predictability.

Hedging is the process by which a consumer or producer protects against adverse price movements that negatively affect revenues or expenses. Hedging involves transferring this adverse price movement risk to a third party. Hedging is used to stabilize costs or revenues. Hedging provides budget and expense predictability.

Pros and Cons of Hedging

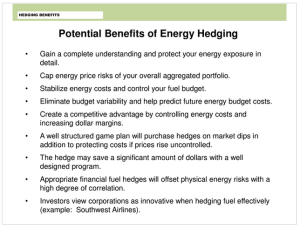

Hedging is a solid business practice when implemented correctly. It enables companies of all sizes to gain a complete understanding of the risk management process and it helps you to protect against your energy exposure. Hedging enables companies to cap their energy price and volumetric risks associated with their overall aggregated portfolio. Hedging helps eliminate budget variability and helps provide predictability to this volatile expense.

Hedging is a solid business practice when implemented correctly. It enables companies of all sizes to gain a complete understanding of the risk management process and it helps you to protect against your energy exposure. Hedging enables companies to cap their energy price and volumetric risks associated with their overall aggregated portfolio. Hedging helps eliminate budget variability and helps provide predictability to this volatile expense.

Conversely, Hedging may increase your aggregated total energy costs as a result of the cost of the hedge. Some hedge structures are much more risky than others in terms of potential losses. Hedging, when improperly implemented can create problems. For a more comprehensive list of the downsides of hedging please refer to the attached document.

Disclosures

The trading of derivatives such as futures, options, and swaps may not be suitable for all investors. The risk of loss in hedging or trading commodities can be substantial and Stabilitas Energy, Inc. assumes no liability for the use of any information contained herein. Past performances are not necessarily indicative of future results. Neither the information, nor any opinion expressed shall be construed as an offer to buy or sell any futures, options on futures contracts, or Over the Counter swaps or options on swaps. Information contained herein was obtained from sources believed to be reliable or is a reasonable assessment of that information, but is not guaranteed as to its accuracy. Reproduction or forwarding without authorization is forbidden. All rights reserved.

The trading of derivatives such as futures, options, and swaps may not be suitable for all investors. The risk of loss in hedging or trading commodities can be substantial and Stabilitas Energy, Inc. assumes no liability for the use of any information contained herein. Past performances are not necessarily indicative of future results. Neither the information, nor any opinion expressed shall be construed as an offer to buy or sell any futures, options on futures contracts, or Over the Counter swaps or options on swaps. Information contained herein was obtained from sources believed to be reliable or is a reasonable assessment of that information, but is not guaranteed as to its accuracy. Reproduction or forwarding without authorization is forbidden. All rights reserved.

Stabilitas Energy, Inc. does not guarantee or warrant that the contents are 100% accurate. We have made reasonable efforts to present accurate information and reasonable opinions as it relates to commodity market information, pricing, and statistics. Therefore, the information is provided “as is” without warranties of any kind. In no event shall Stabilitas Energy, Inc. and its related principals, agents or employees be liable for any damages whatsoever, arising out of or in connection with the report, or other verbal and written communications concerning the report.